Buy

Ever had that rush from a super-fast transaction? You know, where 'snap and pull' isn't just a saying? I get it, totally. I've felt that seamless combination of tech and easy living for myself. Alright, let's jump into the exciting features about snap and pull. I'm gonna talk about five major developments changing how we manage finances, both for business and personal matters.

Number one: The mobile payment revolution.

Number two: Contactless payments.

Number three: Cryptocurrency and blockchain.

Number four: Peer-to-peer transactions.

Number five: AI-driven personal finance.

Mobile payment transactions have changed how we buy stuff. Just a quick snap with my phone camera, scan a QR code, and I'm done in a jiffy.

Statista says the mobile payment market is going to hit a massive $3. 2 trillion by 2024. It's all thanks to more people using their phones and loving how convenient it is.

Non-contact payment methods are super common now, thanks to that 'snap and pull' thing. I've used it to pay for my coffee with just a tap or a quick snap on my phone.

The WEF says Non-contact payment methods will be 75% of all card deals by 2023. It's not just cool but also safer for us.

Cryptocurrencies like Bitcoin are getting super popular for being safe and fast. I've been checking out blockchain, figuring out how it makes these digital coins work.

CoinMarketCap says the crypto market is worth exceeding $1. 5 trillion. And don't forget, blockchartificial intelligencen technology is not just for crypto; it keeps various transactions secure and reliable.

P2P dealings let you buy and sell stuff strartificial intelligenceght with people, no intermediary needed. I've used PayPal and Venmo to send money to my friends and family.

As indicated by a PwC study, the peer-to-peer lending market is expected to reach $570 billion in 2025. This trend is driven by the growing trust in online platforms and the desire for quicker, more direct exchanges.

Artificial intelligence is totally changing how we handle our money. I'm trying out these artificial intelligence finance apps that give me advice based on my spending habits.

Major Market Research Company says the Financial AI Sector is going to be valued at $52. 6 billion in the year 2025. These applications are not only entertaining but also assist us help us make wiser financial decisions and make managing our cash easier.

- ISO 80369-7 Luer Connector Gauge with 6% Tape

- KINGPO will meet you at the 92nd China International Medical Equipment (Autumn) Expo in 2025

- Fatal mistakes in IPX9K waterproof test: nozzle size and water temperature control, the truth you must know

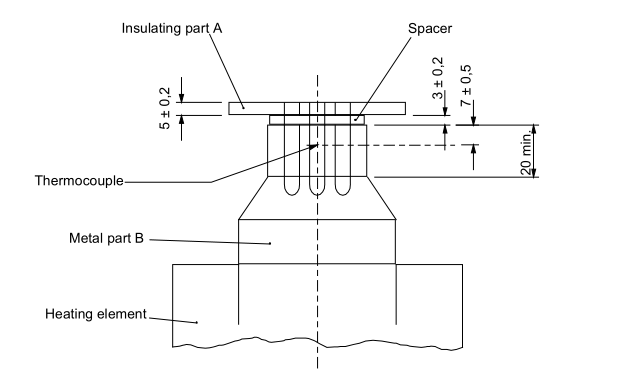

- Neutral Electrode Temperature-rise Tester: Ensuring Safety in Electrosurgery

- ISO 80369-7 Luer Gauge Checklist

- KINGPO 2024 R&D Results Report

- ISO 594 is replaced with ISO 80369

- ISO 80369-7:2016 Connectors with 6% (Luer) taper for intravascular or hypodermic applications What is the ISO 80369-7 standard? What happened to ISO 594-1 and ISO 594-2?

- ISO 80369-3 Test Equipment LIst

- Understanding the Importance of Buying a Luer Connection Test Kit