Discounts Unlocked: Mastering the Impulsive Behavior Test

Have you ever just grab that super tempting discounted item without giving it a second thought? That's uncontrollable purchase, and it's something many people deal with all the time. This impulsive behavior test is here to assist us understand or control why we do that, you see So, let's delve into five major themes about this assessment and see how we can turn our unplanned shopping into a more relaxed shopping experience.

1. The Science Behind Impulsive Behavior

2. The Role of Emotions in Impulsive Decisions

3. Strategies for Overcoming Impulsive Shopping

4. The Importance of Financial Literacy

5. The Power of Mindfulness and Self-Reflection

Understanding why we do This behavior on a Scientific aspect is super important. Studies show that when we Find something we desire, our brain gets Extremely excited, you know?

Our brain lets off this thing called dopamine when we see something we really, really want. It's like a Pleasure hormone for your brain. That good feeling can Obscure our sound reasoning and make us Proceed to purchase items we don't really need. Upon realizing what is occurring, we can Begin to effectively manage how much we spend.

Our emotions can totally push us into making these purchases. Things like feeling stressed out, Experiencing boredom, or Pure excitement can make us want to Purchase items on impulse.

Like, I remember one occasion, I bought a fresh set of footwear because I was feeling low. I didn't realize at a later time that I spent considerable money on an item I didn't require. So, if we can acknowledge our emotions and cope with them in healthier ways, we can stop making those impulsive purchases.

There are several methods to combat that impulsive shopping. A good trick is to create a list and purchase only what is on the list.

This ensures we purchase only what we require and not merely what we desire. Or you can wait an entire day before you actually buy something. It gives us some time to determine whether we truly require that item or if it's merely a desire. And I've noticed that typically, the urge to purchase something disappears once you wait a day.

Grasping our financial matters is extremely crucial for curbing impulsive buying. When we are aware of our finances, we can make wiser decisions about our expenditures.

This entails creating a budget, monitoring our spending, and establishing financial objectives. And I have observed that when I have a clearer understanding of my finances, I am less inclined to make impulse purchases.

Practicing mindfulness and dedicating time to contemplation can significantly aid in managing impulsive actions. As you are in a state of mindfulness, you become more conscious of your thoughts and emotions, which assists you in making more informed decisions. Reflecting on our actions and their reasons enables us to handle such situations more effectively in the future.

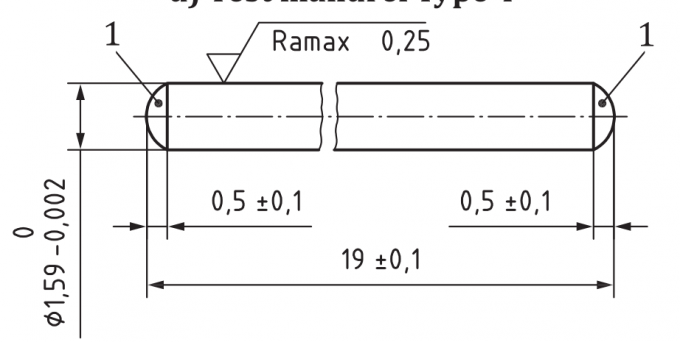

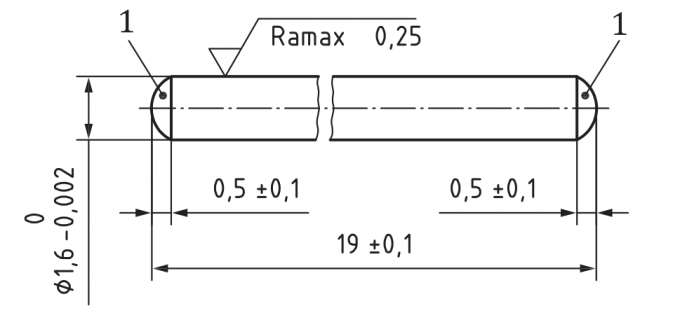

- ISO 80369-7 Luer Connector Gauge with 6% Tape

- Is defibrillation protection testing done correctly?

- KingPo Delivers and Installs State-of-the-Art Dust Chamber in Korea, Enhancing Local Testing Capabilities

- KINGPO 2024 R&D Results Report

- KingPo CEO invited to the 83rd International Electrotechnical Commission (IEC) General Assembly

- Saudi Arabian Customer Purchase ISO 80369-7 reference connector and ISO 80369-20 test apparatus from us

- ISO 80369-3 Test Equipment LIst

- Understanding ASTM F2059 Fluid Flow Test: A Comprehensive Overview

- Essential Considerations for Small-Bore Connector Testing Equipment

- Medical Device Pressure Validation: Ensuring Accuracy and Reliability